Member

Chairman

Positions in the Company and other companies

- Chairman, KAULIN MFG CO, LTD.

- Chairman, Tong Yi Investment Co., Ltd.

- Chairman, Guanglin Investment Co., Ltd.

- Chairman, Kaulin Foundation

Director

Positions in the Company and other companies

- Director, SiRUBA Latin America Inc.

- Director, SiRUBA Singapore

- Director, Young Da LLC

- Chairman, Hung-Lin Investment Co., Ltd.

- Chairman, Gao Cheng Capital

Positions in the Company and other companies

- CEO, Kaulin Foundation

- Chairman, Wei Li Investment Co., Ltd.

Independent Director

Positions in the Company and other companies

- CEO/Attorney, Center & Logic Law Firm

Education

- China University of Political Science and Law

Positions in the Company and other companies

- Associate Professor, Department of Information Management, Chang Gung University

Education

- Ph.D. in Information Management, National Central University

Positions in the Company and other companies

- President, St. John’s University

- Chairman, Taipei Hwa Kang Art School

Education

- Doctor of Laws Chinese Culture University

Positions in the Company and other companies

- Part-time lecturer, Department of Finance, Chinese Culture University

- Independent Director, Kaulin Co., Ltd.

- Independent Director, KHKY Holdings Co., Ltd.

- Independent Director, Kingray Technology Co., Ltd.

- Lecturer of undergraduate program in Financial Management at the Straits College, Minjiang University, Fujian Province, China

- Director of the second term of Taiwan Independent Director Association

Education

- National Taiwan University, Law Credit Class No. 38

- Master, Graduate School of Management, Ming Chuan University

- Department of Accounting, Fu Jen Catholic University

Experience

- Assistant Manager, Deputy General Manager and Director of Underwriting Department of a largescale securities firm

- General Manager and Chairman of Chuan Shan Investment Trust

Diversity and Independence of the Board of Directors

Policy

In accordance with Article 20 of the Company’s “Corporate Governance Best Practice Principles” (Capabilities that the Board of Directors should have as a whole) The Company’s Board of Directors shall guide the Company’s strategies, supervise the management, and be accountable to the Company and its shareholders. The operations and arrangements of its corporate governance system shall ensure that the Board of Directors exercises its powers in accordance with laws and regulations, the Articles of Incorporation or the resolutions of shareholders’ meetings.

The structure of the Company’s Board of Directors should be based on the scale of the Company’s business development and the shareholdings of major shareholders, and the need for practical operations, and determine an appropriate number of directors for five or more members.

The composition of the Board of Directors shall take diversity into consideration. Apart from ensuring that directors who have also serve as company managers do not exceed one-third of the board seats, appropriate diversity policies should be formulated based on the Company’s operations, business model, and development needs. These policies should include, but not limited to, the following two major aspects:

- Basic conditions and values: Gender, age, nationality and culture.

- Professional knowledge and skills: Professional background (such as law, accounting, industry, finance, marketing, or technology), professional skills, and industry experience.

Members of the Board of Directors shall generally possess the necessary knowledge, skills, and literacy to perform their duties. In order to achieve the ideal goal of corporate governance, the Board of Directors as a whole should have the following capabilities:

- Operational judgment.

- Accounting and financial analysis ability.

- Operation and management ability.

- Crisis management capability.

- Industry knowledge.

- International market perspective.

- Leadership.

- Decision-making ability.

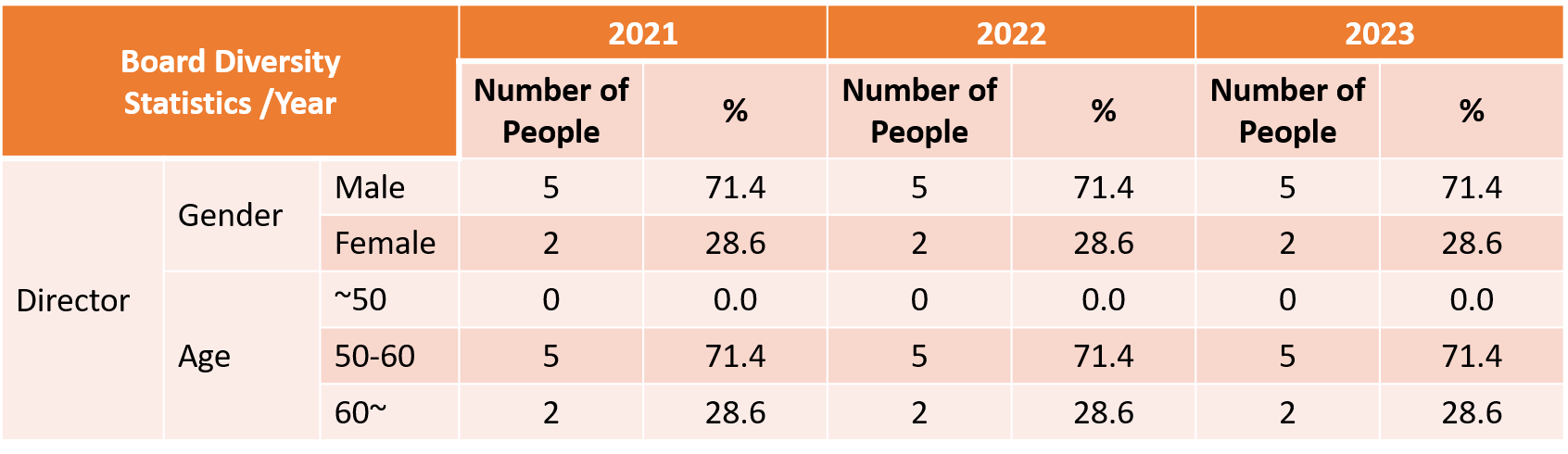

Implementation Status of the Board of Directors Diversity Policy

Statistics of Board Diversity

Independence of the Board of Directors

The Company attaches great importance to the independence and diversity of the members of the Board of Directors. For the independence of the Board of Directors, the goal is to have no less than 3 independent directors and no less than one-fifth (inclusive) of the Board of Directors . In 2023, the Board of Directors had 4 independent directors, making up four-sevenths of the seats. Additionally, the goal is to limit the number of directors who are also employees of the Company to no more than one-third of the seats. In 2023, there were two directors who were also employees of the Company, consisting one-sevenths of the seats. There are three directors who are spouses or relatives within second degree of kinship, comprising three out of seven of the seats.

Link

Market Observation Post System

The succession planning for board members and key management personnel

Succession planning for board members

Our company currently has a total of 7 board members, including 4 independent directors, all of whom possess management expertise in business, finance, accounting, or company operations. The future composition and backgrounds of our board will continue to follow the current structure. The election of directors is conducted through a candidate nomination system, where the shareholders’ meeting selects from a list of director candidates.

In selecting directors, we consider the overall composition of the board. Board members are diversified based on the company’s operations, business model, and developmental needs. Each year, we ensure that directors complete at least 6 hours of continuing education to enhance their knowledge, meet industry demands, and increase professional expertise. Additionally, we conduct annual performance evaluations, with the results serving as a reference for the selection or nomination of directors.

Regarding succession planning for the board, the group has several senior management talents, providing a robust talent pool to fill future board vacancies. The selection of independent directors, as required by law, must include experience in business, legal, financial, accounting, or relevant company operations. There is a sufficient supply of qualified professionals in the domestic market, so our planning for the succession of independent directors may draw from industry experts.

The Board Education and Performance Assessment

To enhance the ethical standards of conduct among our internal staff and to uphold a culture of integrity, we have established not only a “Code of Ethical Conduct” and “Guidelines for Ethical Operations and Behavior,” but also a comprehensive framework encompassing: conflicts of interest prevention, avoidance of personal gain opportunities, confidentiality responsibilities, equitable transactions, safeguarding and appropriate use of corporate assets, adherence to legal regulations, encouragement of reporting unlawful or unethical actions, and disciplinary measures, among others. All these pertinent guidelines have been endorsed by the Board of Directors, put into practice, shared with independent directors, reported at shareholders’ meetings, and communicated to employees. Furthermore, anti-corruption policies have been promoted. Concurrently, we actively advocate for directors’ adherence to the ” Corporate Governance Practices for Listed and OTC Companies.” Throughout their tenures, directors are encouraged to commit a minimum of 6 hours annually to courses on finance, risk management, business, commerce, legal matters, accounting, sustainability, and corporate governance, as well as internal control system and financial reporting responsibilities. We consistently arrange courses for both directors and employees, covering themes like corporate governance, legal compliance, risk management, prevention, money laundering prevention and counter I terrorism. By continuing to provide these courses, we reinforce our commitment to fostering strong corporate governance, legal adherence, risk management, and proactive measures against money laundering and the fight against terrorism.

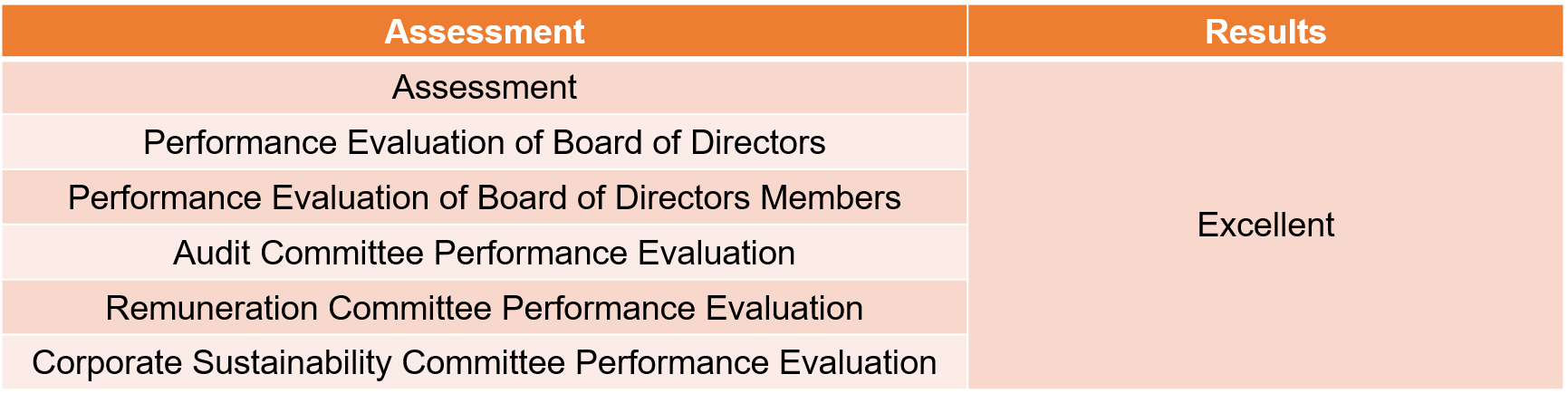

Board Performance Evaluation

Policy

We have established “Board Performance Evaluation Measures,” which are based on Article 4 of the organizational regulations of the Salary and Remuneration Committee. This stipulates an annual performance appraisal to be conducted before the first quarter of each year. The assessment is carried out through a self-assessment questionnaire, covering aspects such as attendance at board meetings, understanding and participation in pre-meeting proposal discussions, interaction with the management team, compliance with laws, and industry standards, efforts to enhance corporate governance, participation in continuous learning of corporate governance related courses, understanding of the company and its industry landscape, and other criteria designated by the competent authority or the board of directors. The primary objective is to regularly review the performance of directors and managers, including their grasp of the management team’s understanding of the company and its industry. To enhance the objectivity of the evaluation process, our company conducts external assessments at least once every three years. To enhance the objectivity of the evaluation process, our company conducts evaluations external assessments at least once every three years. These evaluations are carried out by professional independent institutions or teams

of external experts and scholars.

Self-Assessment Report

Board of Director

The SiRUBA Board of Directors functions as the highest governing authority and a pivotal center of major operating decision. Comprising seven members, including four individual chairmen, the Board includes a Remuneration Committee, an Audit Committee and a Corporate Sustainability Committee. Board members possess extensive experience and professionalism in financial, business, economy, developmental, and managerial domains. Our company held 6 board meetings in 2023 with an attendance rate of 90%.